A combined read that compares hedge behavior across macro regimes and folds in this week simultaneous ETF outflows. The goal is practical guidance for allocation, not slogans.

Daily Market Pulse

| Metric | Status today | Read |

|---|---|---|

| BTC perp funding | Neutral to slightly negative | leverage is light and reactive |

| ETH open interest | Flat day over day | derivatives are not forcing the tape |

| BTC dominance | Sideways after last week uptick | rotation pauses while majors digest |

| 30 day realized volatility | Elevated vs last month | bigger daily ranges require discipline |

The hedge question in 2025

Bitcoin and gold hedge different risks. Bitcoin is a high beta monetary asset with programmable settlement. Gold is a low beta store with deep collateral markets. Both can protect portfolios, but the regime matters. The same portfolio can hold both if the sizing respects their volatilities and liquidity hours.

ETF outflows and what they mean

This week both Bitcoin and gold ETFs printed net outflows. That is unusual. It suggests a broad risk trim across macro holders rather than a single asset story. When both sides see redemptions, allocators are raising cash or cutting beta ahead of events. Watch if outflows persist after the catalyst. If they reverse quickly, the move was a hedge into data not a structural unwind.

Claim vs evidence

| Claim | Evidence today | What to monitor next |

| Bitcoin has replaced gold as the only hedge | Gold still attracts flows during liquidity shocks and policy stress. Bitcoin attracts flows during reflation and digital adoption waves. | Track cross asset ETF creations and redemptions around macro prints. |

| Gold is obsolete in a digital world | Gold collateral markets remain deep and cheap to use. Bitcoin custody is improving fast but still carries different operational risks. | Monitor custody insurance limits and policy engines at large custodians. |

| When both ETFs see outflows the hedge case is broken | Simultaneous outflows can simply reflect de risk before catalysts. The hedge case is intact if flows normalize after the event. | Look for a return to net creations and for basis to stabilize across venues. |

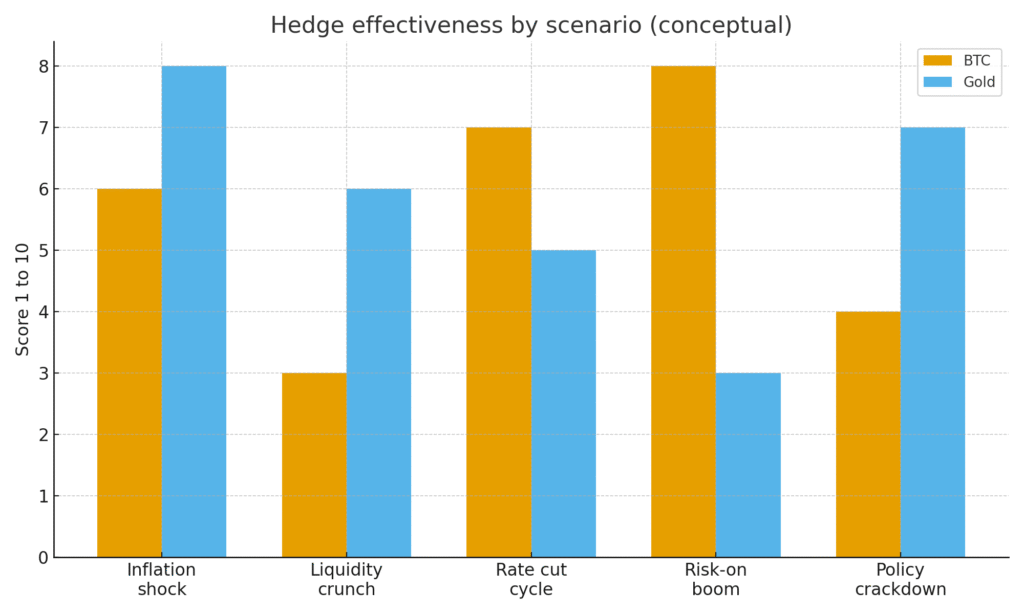

Hedge behavior by scenario

Use the table and the figure to map which asset fits each risk.

| Scenario | BTC behavior | Gold behavior | Notes |

| Inflation shock | Can rise with adoption and supply narrative | Tends to rally as a classic inflation hedge | Position size to volatility and avoid leverage |

| Liquidity crunch | Can draw down with risk assets | Often holds up better due to collateral demand | Keep dry powder and widen stops |

| Rate cut cycle | Benefits from easier liquidity and narrative flows | Mixed response depending on growth outlook | Favor BTC if cuts follow disinflation |

| Risk on boom | Outperforms with beta and new issuance | Can lag as carry and equities lead | Rotate weight to BTC with clear trends |

| Policy crackdown | Sensitive to regulatory headlines | Often steadier due to incumbent status | Use options or reduce net exposure |

Figure 1. Bar chart of hedge effectiveness by scenario. Bitcoin leads in risk on boom and rate cut cycle, Gold leads in inflation shock, liquidity crunch, and policy crackdown.

Portfolio playbook

Set base positions using a volatility budget rather than equal notional size.

Rebalance after weekly closes, not intraday noise.

Add optionality around macro prints to protect downside.

Use both assets when regimes are mixed. Let data decide the tilt each month.

Treat ETF flow data as a signal of allocator behavior rather than a price target.

Risk checklist

Custody drift and key management errors.

Basis dislocations across ETF and spot venues.

Policy shocks that change stable value rules or settlement plumbing.

Liquidity gaps during off hours for your mandate.

Bottom line

Bitcoin and gold can both hedge. They do it in different ways. The right mix depends on your risk and on the week you are trading. Simultaneous ETF outflows point to a risk trim, not a broken thesis. Let flows and volatility guide your tilt, then stay patient.