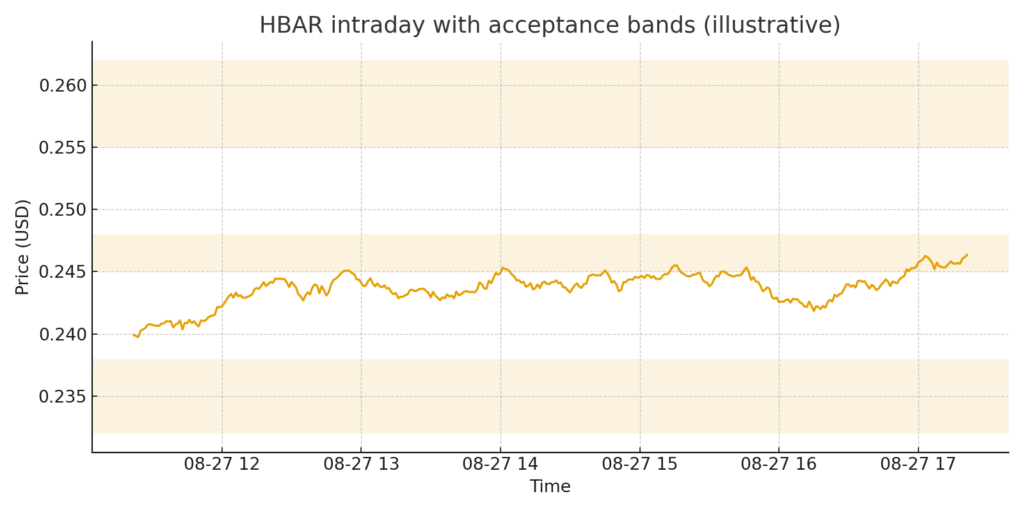

HBAR’s resilience around 0.24 signals a balanced tape. Spot interest is consistent, derivatives positioning is not one‑sided, and realized volatility remains moderate. The focus near term is whether the market accepts above 0.245–0.248 or fades into prior value. Use the levels and scenarios below to guide entries and risk.

Token pulse

| Metric | Reading | Signal | Comment |

|---|---|---|---|

| 24 h spot volume | modestly above 7D avg | ↑ | Rotation into quality L1s continues. |

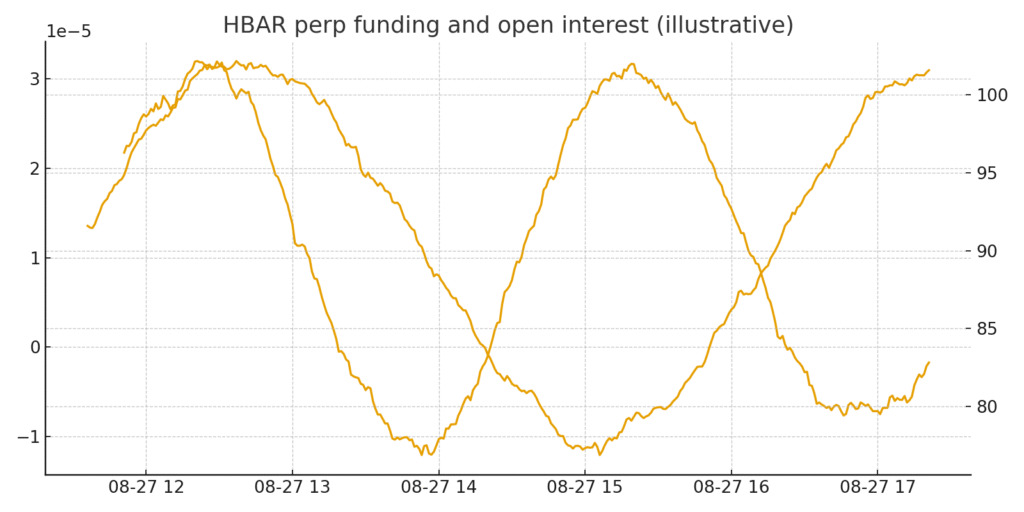

| Funding (perps) | neutral | ↔︎ | No forced squeeze setup. |

| Open interest | steady | ↔︎ | Positioning not stretched. |

| Realized vol (7–30D) | mid‑range | ↔︎ | Trend days are scarce; trade levels. |

Levels to watch

Support 0.232 to 0.238.

Acceptance band 0.245 to 0.248.

Resistance 0.255 then 0.262.

Invalidation hourly close below 0.231 with accelerating volume.

Figure 1. HBAR intraday with acceptance bands

Microstructure notes

Liquidity shelves. Books show firmer resting interest below 0.24 than above 0.25, which argues for mean reversion unless volume expands.

Correlation watch. Beta to BTC remains lower than to the L1 basket; monitor ETH rotations for context.

Scenarios for 24–72 hours

Acceptance into 0.248–0.255. Strategy: scale in on retests of 0.248 with stops below 0.244, target 0.255–0.262.

Range fade. Rejection around 0.248 pulls price toward 0.238–0.240; take profits in the middle of the range to avoid stalled fills.

Stop‑run and spring. Wick into 0.231–0.233 followed by a quick reclaim; consider a small counter move with tight risk.

Risk controls

Define max loss per idea before entry.

Reduce size during low liquidity sessions.

Track funding skew for hints of crowded positioning.

Figure 2. Funding and OI snapshot

Conclusion

HBAR’s tape rewards disciplined level trading. Let price prove acceptance with volume, manage risk tightly around 0.248, and keep expectations in check unless breadth across L1s improves.

Related Posts

- Stellar’s XLM tests 0.40 market pathways and actionable levels

XRP jumps on softer Fed tone with a validation map from 3 to 5 and scenarios up to 8