The approach toward 0.40 acts as a psychological and technical hinge for XLM. Liquidity is clustered in the 0.385 to 0.405 band, derivatives positioning remains modest, and the broader market regime still rewards patient entries with tight invalidations rather than momentum chasing. This brief frames the trade with levels, scenarios, and a compact risk map you can use in the next 24 to 72 hours.

Token pulse (indicative)

| Metric | Reading | Signal | Comment |

|---|---|---|---|

| 24 h volume (spot) | elevated vs 7D avg | ↑ | Attention returning to majors and select L1s. |

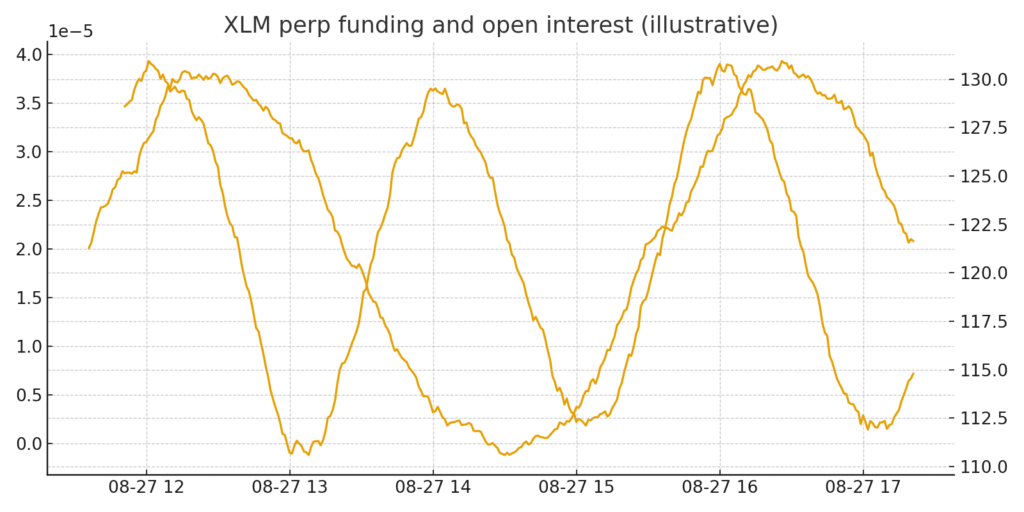

| Funding (perps) | neutral to slightly positive | ↔︎ | No crowded one‑sided leverage. |

| OI (perps + futures) | stable | ↔︎ | Rotations exist but not extreme. |

| Implied/realized vol (7–30D) | climbing from lows | ↗︎ | Breakouts can fade; respect invalidations. |

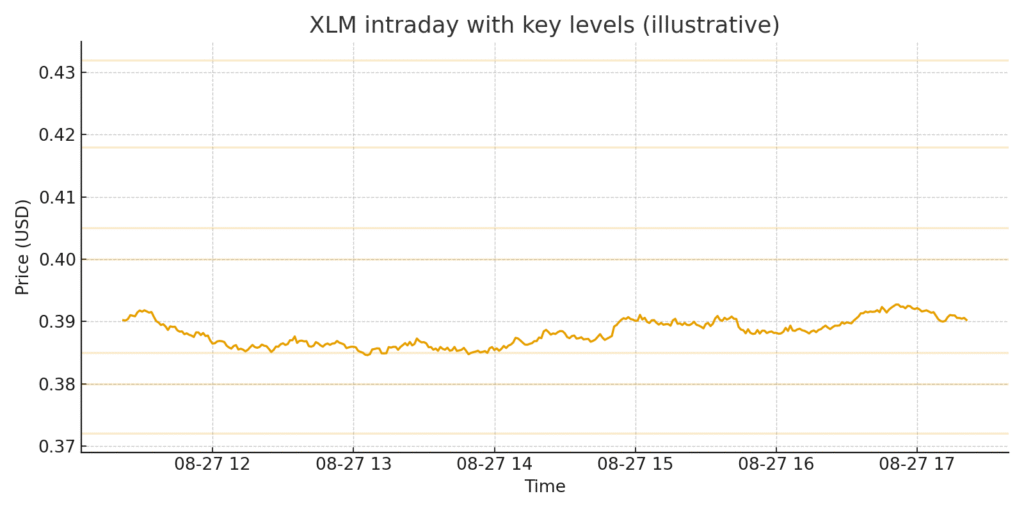

Key levels to watch

Support 0.372 to 0.380.

Control zone 0.385 to 0.405 around the 0.40 handle.

Resistance 0.418 then 0.432.

Invalidation hourly close below 0.368 with rising volume.

Figure 1. XLM intraday levels heatmap

Market structure and flows

Spot‑led moves. The first impulse into 0.40 has been spot‑driven with derivatives confirming after the fact. Funding neutrality reduces squeeze risk in either direction but also limits follow‑through.

Depth pockets. Order book depth thins above the round number, so breaks can overshoot and quickly retrace into the control zone.

Correlation. High beta to broader L1 baskets persists; watch BTC dominance and ETH rotations to gauge risk appetite.

Figure 2. Perp funding and open interest snapshot

Scenarios for 24–72 hours

Acceptance above 0.405. Quick run into 0.418–0.432 is possible if volume scales and funding stays contained. Strategy: scale‑in on retests of 0.405 with a hard stop below 0.398.

Rejection at the handle. Failure near 0.40 with weak volume likely fades into 0.385–0.390. Strategy: fade the first rejection with stops above the high; cover into mid‑range.

False break then trend. A wick through 0.41 followed by a close back under 0.40 often precedes a deeper test of 0.372–0.380. Strategy: wait for confirmation and use tight risk.

Risk map

Macro headline risk. Unexpected policy remarks can compress or expand ranges quickly.

Weekend and off‑hours liquidity. Slippage rises outside U.S. and EU sessions.

Funding skew flip. A sudden positive skew can telegraph a squeeze; cut exposure if it accelerates.

Execution checklist

Define entry, invalidation, and take‑profit before placing orders.

Avoid chasing candles; let price return to your levels.

Position size modestly when trading near round‑number hinges.

Conclusion

The 0.40 handle concentrates attention, but the signal remains the same. Let price prove acceptance with volume, trade the retest, and keep invalidations tight. In rejection scenarios, be disciplined about taking partial profits inside the range.

Related Posts

External Sources

Disclaimer: This article is for informational and educational purposes only. It does not constitute investment, financial, legal, or tax advice, nor a solicitation to buy or sell any asset. Digital assets are volatile and may lose value. Always do your own research and consult a licensed professional. Past performance is not indicative of future results.