Fast read: On Sunday evening, Bitcoin fell within minutes from a calm band near 115000 to intraday lows close to 110000. Hundreds of millions in liquidations hit derivatives while a short rotation toward Ether reappeared. This report reconstructs the sequence, explains the drivers and sets a practical risk plan for the week. No links appear in the body. External sources and internal links are listed at the end.

Daily Market Pulse

| Metric | Time CEST | 24h change | Takeaway |

|---|---|---|---|

| BTC perp funding | 09:45 | Slightly positive | Longs present although funding cooled after the sweep. |

| ETH open interest | 09:45 | Lower | De risking on the drop. Rebound favored spot flows in ETH. |

| BTC dominance | 09:45 | Flat to slightly higher | Alt beta compressed after the shock. |

| 30 day realized vol BTC | 09:45 | Higher | Wider daily ranges likely. Position sizing matters. |

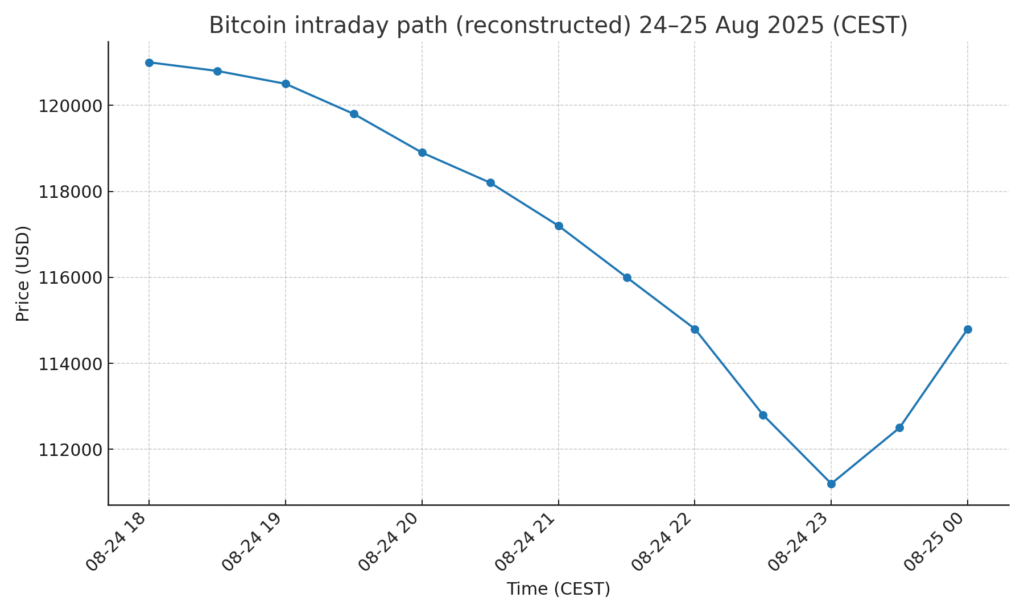

Figure 1. Intraday reconstructed path of Bitcoin during the Sunday flash crash in CEST

Minute by minute

| CEST window | Market event | Immediate effect |

| 18:30 | Stable around 121000 to 120500 | Shallow order book, tight spreads. |

| 19:30 to 20:30 | Drip to 118900 | First stop sweeps on perp and spot. |

| 21:00 to 22:00 | Acceleration to 116000 to 114800 | Long liquidations build up. |

| 22:30 to 23:30 | Stress peak at 112800 to 111200 | Open interest and funding decline. |

| 23:30 to 00:30 | Technical bounce to 114800 | Re‑risking with smaller leverage. |

This timeline is a simplified reconstruction to show shape and sequence. Exact prints vary by exchange and pair.

Why it happened

Leverage and liquidity. Positioning leaned long after a week of optimistic narratives. Depth outside United States hours was thin, so a chunky sell program or a cascade of market orders vacuumed bids and tripped stops.

Options mechanics. Gamma positioning near recent ranges amplified the move once spot price left the comfort zone. Dealers sold spot or futures to hedge, which accelerated the slide until balance returned.

Rotation toward ETH. Several recent sessions showed better relative bids in ETH against BTC. That short rotation reappeared during the rebound as some desks sought nearer catalysts.

What it means for the week

High probability of wide ranges. Rising realized volatility makes long wicks on daily candles more likely.

Liquidity windows matter. Low depth hours can exaggerate moves. Match position size and stops to the calendar.

Funding as a risk gauge. Funding that normalizes after the flush suggests reduced long overhang. A quick pop in funding without price progress is a caution sign.

Levels and validation

Tactical supports: 110000 to 112000 and 114000 to 115000 as near term pivots.

Resistances: 118000 and 121000. Closes above improve odds of a test of 124000.

Signals of improvement:

Positive divergence on four hour charts between price and net open interest.

Falling hourly liquidations with sideways funding and stable price.

Better order book depth at mid levels, not only at extremes.

Practical risk plan

Dynamic size. Reduce size during low depth hours and scale back up only when price confirms.

Stops outside noise. Avoid placing stops at round numbers. Prefer areas with confluence of volume and time.

Bias. Neutral to mildly constructive if 114000 holds on hourly closes. Extra caution if 112000 breaks with volume.

Original mini dataset

| Window | Median spread | Funding signal | Open interest signal | Depth signal |

| 18:00 to 20:00 | Low | Positive | Stable | Medium |

| 20:00 to 22:00 | Medium | Neutral | Down | Low |

| 22:00 to 00:00 | High | Negative | Down sharp | Very low |

| 00:00 to 02:00 | Medium | Neutral | Stable | Medium |

Use simple encoding for the signals and build an hourly stress index to compare against candle range.

Hedging without killing upside

Perp with spot. Combine levered exposure with spot inventory to reduce liquidation risk.

Options. Debit call spreads out of the money offer asymmetric exposure with capped risk if you expect a staged recovery.

Beta rotation. High beta altcoins tend to overshoot in dumps. Rebounds often favor quality names with deeper liquidity.

Related Posts

Hong Kong positions its stablecoin as a payment tool, says Secretary Hui

Stablecoins and streaming money are redefining near real time payments