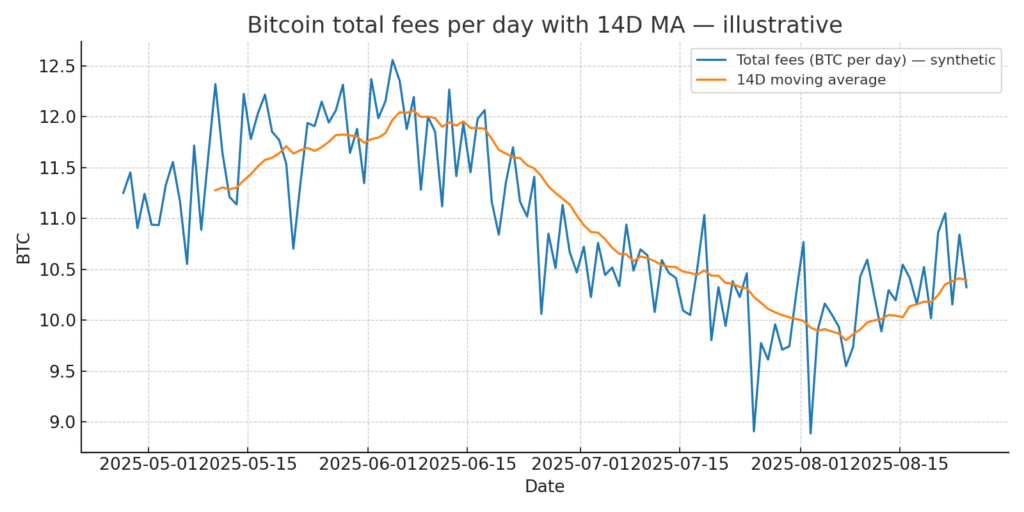

User paid fees on Bitcoin have touched a cycle floor when measured in BTC per day. Recent readings point to roughly 3.5 to 4.1 BTC per day on short moving averages, a level last seen in 2011. The data has implications for miner economics, network congestion and fee policy design for self‑custody wallets and custodians.

What the data shows

BTC terms: 14D moving averages near 3.5 to 4.1 BTC per day.

USD terms: average fee per transaction below 1 USD on recent prints. This reflects a clean mempool and improved transaction packing.

Cyclical context: After inscription‑led spikes, usage normalised while upper layers absorb volume.

Figure 1. Total fees in BTC per day with 14D MA

Why fees fell

Batching and UTXO consolidation. Exchanges improved withdrawal engineering and consolidation routines.

Upper layers growth. More activity moves off base layer and settles in batches.

Cleaner traffic. Fewer spam bursts and steadier usage patterns.

Market pause. In consolidation phases users bid less for priority.

Impact on miners and security

Fee revenue: down as a share of total. With a high BTC price, the drop in BTC fees can be offset in USD. If price retraces, margins compress.

Health signal: low fees do not imply a weak network. They indicate a clear mempool and enough capacity for current demand.

Medium term incentives: as upper layers grow, periodic base‑layer spikes may need to support security economics.

Fee drivers snapshot

| Driver | Current direction | Signal for users |

|---|---|---|

| Mempool and priority | Low to moderate | Low cost with reasonable confirmations |

| Average transaction size | Stable to lower | Savings if batching and SegWit are used |

| Block competition | Moderate | Market‑efficient fees |

What to do today

Plan UTXO consolidations during off‑peak hours.

Use the cheap window to move funds from cold to hot if needed.

Check withdrawal policies at your custodian to benefit from dynamic fees.