Executive brief

Europe has clear rules for digital assets. Poland is now aligning national practice with those rules. This article weighs the trade offs. It explains why strict licenses can protect users yet still push small firms to exit. It also lists simple steps that improve safety without killing growth. No investment advice.

Editor’s note: The body includes no links. Sources appear at the end.

Why this question matters

First, founders choose places where rules are clear and costs are known. Next, investors prefer markets where custody and disclosures are standard. Then, users benefit when scams fall and stable firms remain. However, higher entry costs can shrink the local scene. As a result value can move to other hubs even if access remains.

The policy trade offs at a glance

| Policy choice | Potential benefit | Potential cost |

|---|---|---|

| Tight licensing and high capital thresholds | Fewer scams and easier supervision | Consolidation that hurts small local firms |

| Transitional relief and sandboxes | Faster tests with guardrails | Harder to police and uneven enforcement |

| Passportability under MiCA | Scale across borders for compliant firms | National overlays that blunt the benefit |

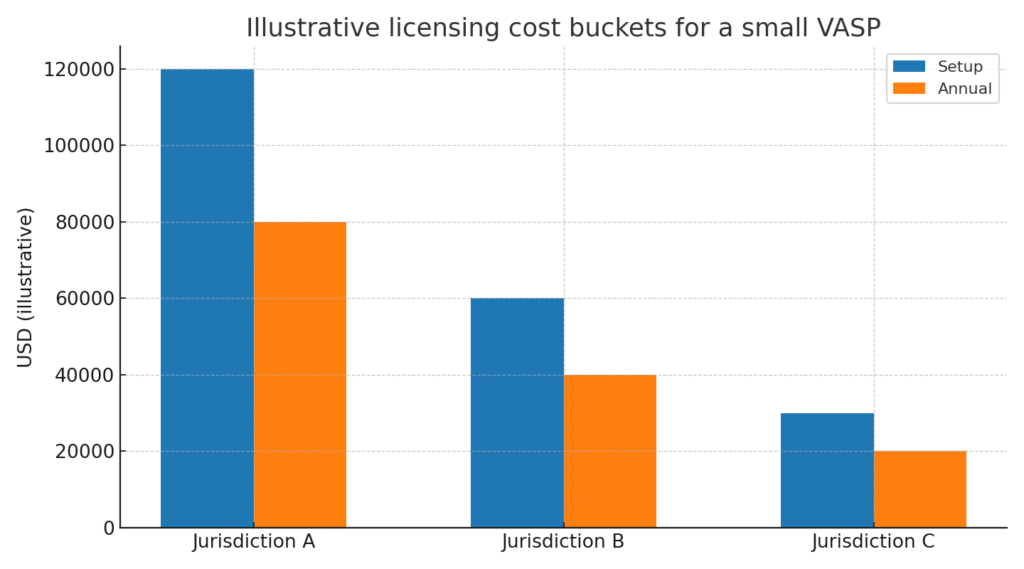

Figure 1. Bar chart comparing illustrative licensing cost buckets for a small VASP across three regimes

Case signals to watch

To begin, reports suggest many Polish exchanges may consolidate or close under higher costs. In parallel, media commentary warns that Europe could fall behind if talent chases lighter regimes. At the same time, countries with predictable pipelines continue to attract institutional products. Together these signals show a split path.

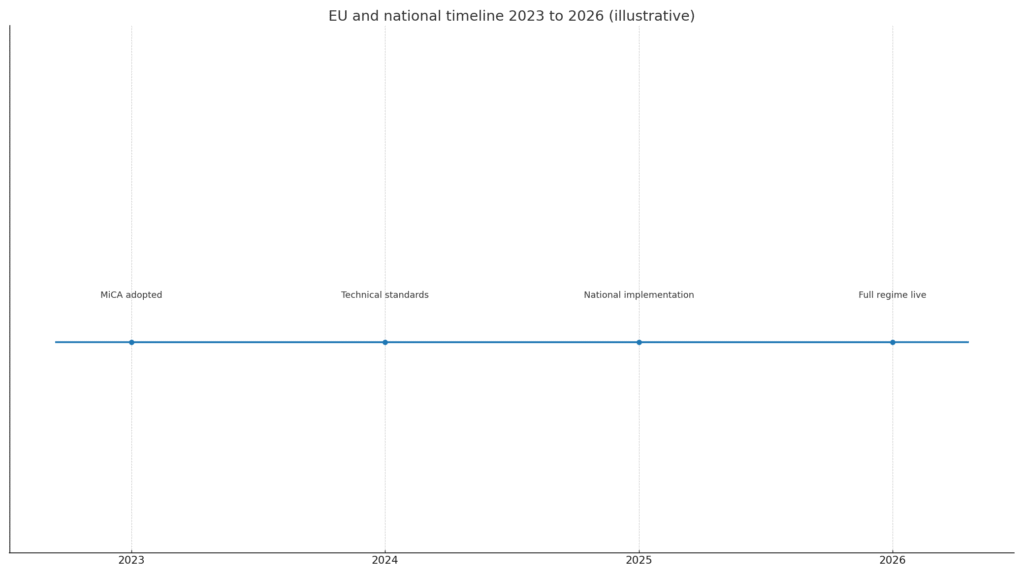

Figure 2. Timeline chronology of EU and national milestones for 2023 to 2026

What missing the boom would mean in practice

It would not mean zero activity. Instead, it would mean that the next wave of on chain finance lands in hubs with clear timelines and scale. Local users could still buy and hold assets. Yet jobs, tax base, and know how would concentrate elsewhere. Therefore policy choices decide where value is captured.

Practical steps Poland can take now

First, publish fee schedules and target timelines for every license.

Second, issue plain language notes on custody, staking, and stablecoin rules.

Third, expand sandboxes with public metrics and firm end dates.

Fourth, partner with universities to train compliance ready talent.

Finally, work at the EU level to reduce conflicting national overlays.

A simple cost picture for small firms

Insert PNG chart here comparative licensing cost buckets for a small VASP across three regimes. Place this image after this paragraph.

In clear terms, higher capital and audit costs can push small firms to merge or leave. Meanwhile large players absorb those costs more easily. As a result the market can tilt toward a few heavyweights. That outcome may reduce scams. It can also reduce local choice and slow product variety.

Timeline where policy stands in Europe

Insert PNG timeline here EU and national milestones from 2023 to 2026. Place the image after this line.

In 2023 Europe adopted the main rule set. During 2024 technical standards moved forward. Through 2025 national teams translate rules into day to day practice. By 2026 the full regime should be live. Therefore the next year is the key test for balance between safety and growth.

What good looks like for users and for firms

For users, trust improves when disclosures use the same format every month. For firms, predictability improves when reviews are timely and fees are known. For supervisors, analytics improve when reports use common tags. In short, clear templates and stable timetables help everyone.

Bottom line

Europe is not doomed to miss the boom. Poland is not either. With clear processes, short feedback loops, and measured sandboxes, the country can protect users and still keep talent at home. The task now is execution.

Related Posts

• Wall Street closes higher as Powell hints at a September rate cut the crypto angle

• Issuers ramp up crypto ETF filings ahead of an expected launch window

• Ethereum sets a new all time high as markets price a September rate cut

External Sources

• Euronews feature raising the question for Poland and Europe

• Yahoo News mirror pointing back to Euronews

• Roundup on Polish exchanges and MiCA pressure