A first for the United States market: an ETF proposal that wraps JitoSOL, a liquid staking token on Solana. If approved, this would carry staking yield and smart contract risk into a registered fund wrapper. Here is how it could work and what regulators will focus on.

What has been filed

VanEck submitted paperwork for a JitoSOL ETF intended to give traditional investors access to SOL denominated staking yield via a liquid staking token. Recent Solana ETF amendments elsewhere show that the SEC is cautious but engaging with layer one products.

Governance and custody blueprint

| Component | How it would work | What to validate |

|---|---|---|

| Asset | ETF holds JitoSOL | Liquidity, reward tracking, smart contract upgrades |

| Yield | Accrues via Jito mechanics | Yield reporting, NAV treatment, income distributions |

| Custody | Qualified custodian with staking key controls | Segregation, slashing insurance or coverage |

| Risk | Smart contract and validator slashing | Auditor testing and diversification across validators |

Scenario analysis if approved

Demand: yield seeking allocators may treat it as SOL with carry inside brokerage accounts.

Tracking error: reward accruals versus daily NAV. Creation and redemption frictions in volatile sessions.

Market structure: liquidity needs in SOL and JitoSOL pairs. AP inventory management.

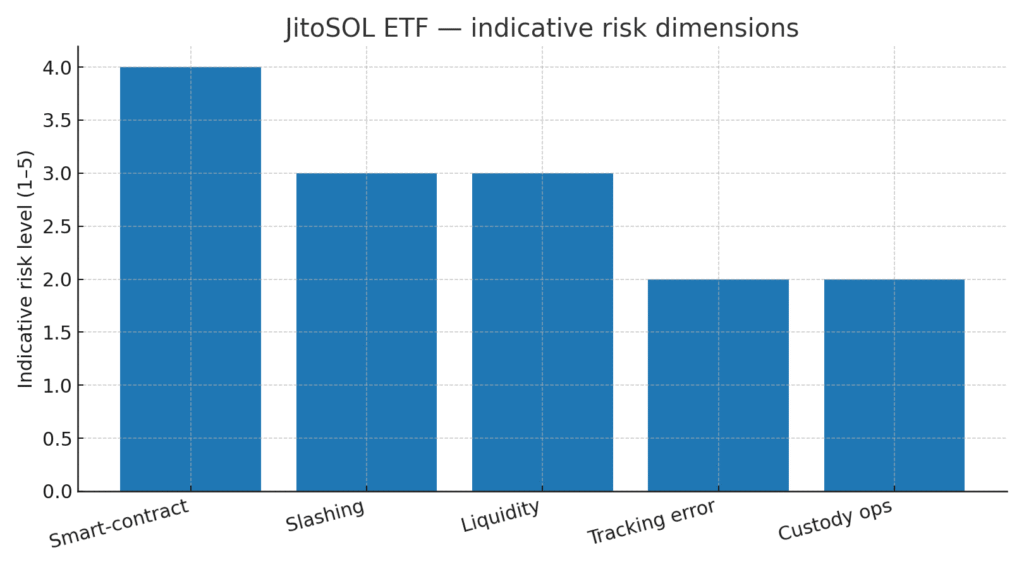

Indicative risk dimensions

Caption: Risk dimensions for a JitoSOL ETF on a 1 to 5 scale, illustrative.

Note: Editorial mapping, not investment advice.

Regulator questions to watch

Is staking income treated as distribution or NAV accretion

How are slashing events handled in disclosures and reserves

Are potential conflicts such as validator selection managed and audited

Related Posts

AUSTRAC orders Binance Australia to appoint an external auditor over serious concerns

U.S. stablecoin law pushes the EU to rethink the digital euro

South Korea’s big four banks meet Tether and Circle on stablecoin partnerships

External Sources