Leadership changes do not change the destination. United States digital asset tax reporting is tightening. With the head of the IRS crypto work departing for the private sector, here is what is changing and how to prepare.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

What happened

The head of the IRS digital assets effort is leaving the agency for a private sector role.

This lands as the Form 1099 DA broker reporting regime rolls out for 2025 transactions, with phased guidance and transition relief.

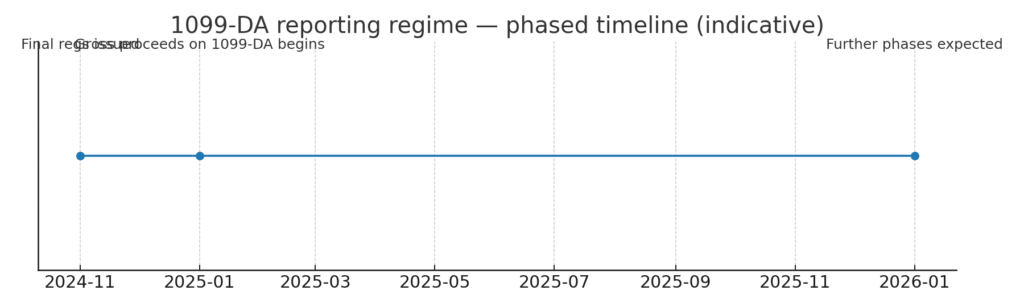

1099 DA phased timeline

Caption: 1099 DA reporting regime timeline, indicative.

Note: Built from IRS and Treasury communications, for guidance only.

Reporting regime at a glance

Year 2024: final regulations issued, defining covered brokers and transactions.

Year 2025: gross proceeds reporting begins on Form 1099 DA. Basis reporting largely deferred. Transition relief applies in parts.

Year 2026: additional requirements expected to phase in as instructions update.

Threat model for taxpayers

| Risk | How it appears | Impact |

|---|---|---|

| Mismatched 1099 DA | Broker reports sales you did not match | Notices and penalties |

| Staking or airdrop income | No cost basis captured | Underreported income risk |

| Self custody transfers | Looks like sales | False gains or losses if not reconciled |

| Cross chain moves | Breaks lot tracking | Basis errors and audit flags |

Defense playbook: practical steps now

Single source of truth. Consolidate trade history across exchanges, wallets, and DeFi into one ledger.

Tag transfers between your own wallets to avoid phantom disposals.

Log income events such as staking, airdrops, and mining at timestamped fair value.

Keep cost basis and lot IDs. Match broker 1099 DA proceeds with your records.

Backup withholding readiness. Ensure TIN and KYC data are correct to avoid avoidable withholding.

Why leadership changes matter and why they do not

Turnover might slow FAQs and staff memos for a short time, but the broader policy is anchored by final regulations and statutory mandates. Congress may still adjust the perimeter, for example the debate over DeFi broker scope, yet the compliance trend line remains one way.

AUSTRAC orders Binance Australia to appoint an external auditor over serious concerns

U.S. stablecoin law pushes the EU to rethink the digital euro

South Korea’s big four banks meet Tether and Circle on stablecoin partnerships

External Sources