Filings are stacking up again, a classic tell ahead of rule changes or green lights. The latest batch includes a broad multi asset fund and leveraged single token strategies. Exchanges are tweaking listing rules. Here is the useful map, not the hype.

Issuer dossier

| Issuer | Product | Exposure type | What stands out |

|---|---|---|---|

| 21Shares | Multi asset crypto fund | Tokens, ETFs, derivatives, equities | Flexible toolbox for allocators |

| 21Shares | DOGE leveraged fund | Derivatives | Thematic, trader oriented |

| 21Shares | SUI leveraged fund | Derivatives | Tests depth and liquidity in newer L1s |

Governance and custody blueprint

| Component | Basket or index ETF | Leveraged single name |

| Asset coverage | Index methodology and rebalancing | Derivatives exposure and collateral rules |

| Custody | Qualified custodians and off exchange settlement | Margin and collateral segregation |

| Risk | Index drift and liquidity gaps | Leverage decay and market making depth |

| Disclosure | Methodology, fees, tax | Daily exposure, VaR, stress tests |

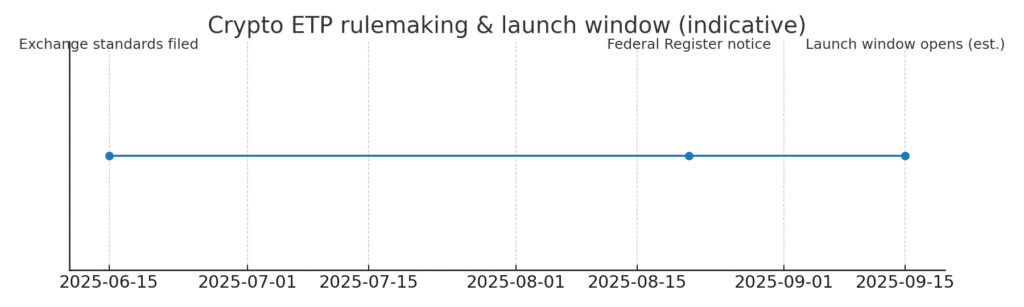

ETP rulemaking and launch window timeline

Timeline distilled from public notices and editorial estimates.

Why now

Rule plumbing: Cboe BZX and NYSE Arca proposed standards that may streamline crypto ETP listings once categories are defined.

Regulatory cadence: the SEC has been designating longer periods and posting amendments, a typical step before decisions.

Precedent building: multi crypto ETP approvals and index trust tweaks indicate comfort with broader exposures.

Timeline in words

Quarter two to quarter three 2025: exchanges file standards and issuers refresh registration statements.

Late quarter three 2025: designations of longer periods and publication of amendments.

Launch window: depends on staff comments. First movers likely baskets or theme funds, followed by L1 single names.

Allocator checklist

Structure: 1940 Act fund versus grantor trust versus commodity ETP.

Liquidity: primary market creation or redemption and AP depth.

Tracking: methodology, fees, and slippage in volatile sessions.

Tax: K 1 risk versus 1099, custody jurisdiction, and staking treatment if applicable.

Related Posts

AUSTRAC orders Binance Australia to appoint an external auditor over serious concerns

U.S. stablecoin law pushes the EU to rethink the digital euro

South Korea’s big four banks meet Tether and Circle on stablecoin partnerships

External Sources