Daily Market Pulse

| Metric | Latest read | Why it matters |

|---|---|---|

| BTC perp funding | Positive tilt across major venues | Risk appetite returning after Powell hint at easing |

| ETH 30 day realized vol | Rising | Breakout after months of compression |

| BTC dominance | Slightly lower | Rotation toward ETH and L2 or LST themes |

| Open interest across majors | Building | Momentum plus short covering adds fuel |

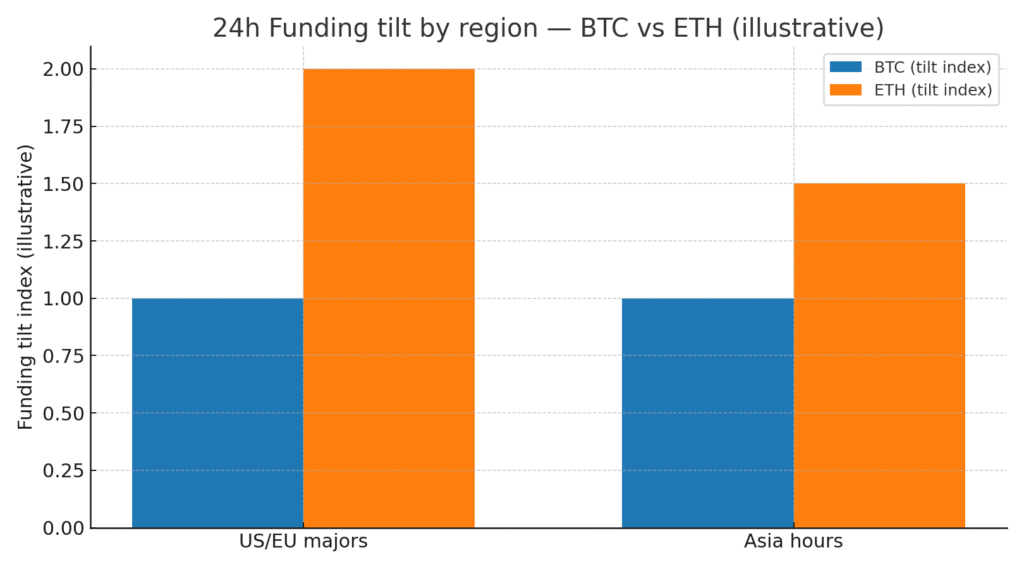

24 hour funding tilt by region

Funding tilt index for BTC and ETH by region, illustrative.

Note: TheCryptoTides analysis, conceptual not market data.

Tape reader notes

Spot led first, then perps chased. Funding flipped positive and stayed orderly.

Liquidations: a sharp squeeze forced sizable futures wipes across majors.

Options: near dated call skew steepened. Dealers added gamma on top side strikes.

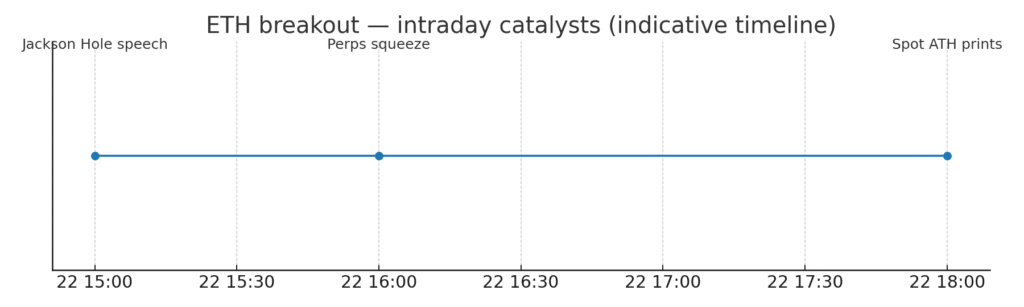

Breakout catalyst timeline

ETH breakout intraday catalysts, indicative timeline

Levels and flows to watch

Former resistance is now first support on higher time frames.

Options open interest clusters on round numbers. Watch intraday pinning into United States close.

Staking and restaking beta: LSTs and AVS narratives often overreact after ETH breakouts.

Mini dataset: 24 hour funding tilt (illustrative)

| Venue bucket | BTC | ETH |

| US and EU majors | + | ++ |

| Asia hours | + | + |

Legend: + positive tilt, ++ strongly positive. Values are indicative for education, not signals.

Catalyst timeline in words

Jackson Hole speech lowered yields and a softer dollar supported risk.

Crypto perps saw a short squeeze and funding normalization.

ETH spot ATH rotated flows into staking adjacent names.

Risk matrix: what could invalidate the breakout

| Risk | How it could appear | Mitigant to watch |

| Hot inflation print | Yields reprice higher and the dollar jumps | Options skew flips and breadth narrows |

| Liquidity drain | Open interest fades and funding turns negative | Spot led rebounds fail at VWAP |

| Regulatory shock | Headline driven gap down | Rotation into BTC and stables bid |

Portfolio angles

Momentum: stagger entries around pullbacks to prior resistance.

Relative value: ETH over BTC until dominance stabilizes.

Satellites: selective L2 and LST exposure with tight risk.

Related Posts

AUSTRAC orders Binance Australia to appoint an external auditor over serious concerns

U.S. stablecoin law pushes the EU to rethink the digital euro

South Korea’s big four banks meet Tether and Circle on stablecoin partnerships

External Sources