Key takeaways

The new U.S. stablecoin law provides a clear framework for payment stablecoins and intensifies pressure on Europe to accelerate the digital euro.

EU officials are openly discussing the use of public chains such as Ethereum or Solana, rather than only private rails.

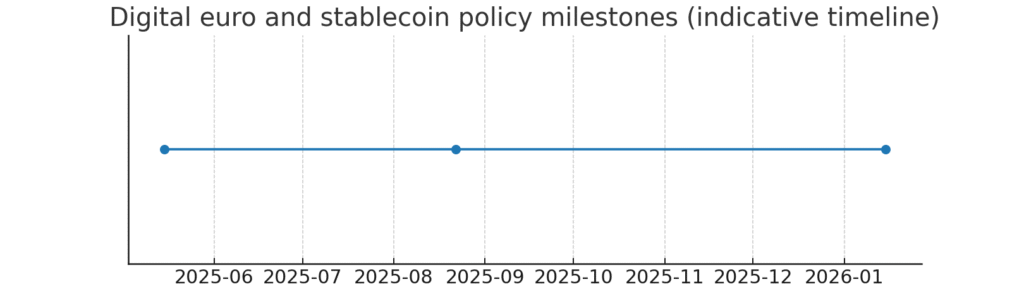

The ECB targets a political deal on the digital euro by early 2026, with technical work continuing in parallel.

Why the board is shifting

Dollar stablecoins dominate on‑chain payments and tokenized capital markets. A clear U.S. regime reduces uncertainty for issuers and banks and forces the EU to protect monetary sovereignty and competitiveness.

Policy matrix

| Item | U.S. stablecoin law | EU MiCA for stablecoins | Digital euro program |

|---|---|---|---|

| Scope | Payment stablecoin issuers with 1:1 reserves | ARTs and EMTs with capital, governance and disclosure rules | Central bank money for retail use |

| Oversight | Federal and state regulators, qualified custody | ESMA and EBA plus national authorities | ECB and Eurosystem, enabling law pending |

| Technology | Open to multiple networks and custodians | Public or private chains under MiCA | Architecture under evaluation, pilots ongoing |

| Objective | Payments and tokenized settlement in dollars | Market stability and consumer protection | Sovereignty and secure online and offline payments |

Fresh official signals

ECB aims for a political agreement by early 2026 and keeps technical readiness on track.

European Parliament continues research on stablecoin impact on monetary policy.

Technical pilots: experiments with private providers and multiple partners via the ECB’s innovation platform.

Indicative timeline for U.S. stablecoin law and ECB digital euro milestones

Policy milestones: U.S. stablecoin law and ECB digital euro (indicative)

Scenarios for the EU

Push the digital euro with a modular design and bank and PSP APIs.

Practical coexistence: euro stablecoins under MiCA coexist with a digital euro that serves as a general purpose layer.

Multi‑network approach: interoperability between public and private rails with strong privacy and offline capabilities.

Impact table

| Actor | Immediate effect | 12 to 24 month effect | What to watch |

| European banks | Rising demand for on‑chain USD and EUR settlement | New tokenized money products | Custody rules and wallet limits |

| Crypto fintech | More clarity for listings and fiat ramps | Level playing field for USD and EUR tokens | Interoperability and KYC by jurisdiction |

| Merchants | More payment options and less cross‑border friction | Wallet adoption by customers | Costs and chargeback rules |

| Investors | Lower regulatory risk for USD on‑chain | Differentiation between EURC and a digital euro | Treasury yields on reserves |

Open questions

Privacy and limits for small offline payments in a digital euro.

Prudential treatment of reserves for European issuers and exposure to sovereign debt.

How to avoid deposit flight from banks into dollar stablecoins.

What is next

Legislative calendar in Parliament and Council.

Merchant pilots and point of sale testing.

AML and travel rule parameters in the digital euro stack.