Verified facts

AUSTRAC directed Binance Australia to appoint an external auditor after identifying serious concerns about its AML/CTF program.

The subsidiary has 28 days to propose auditors for the regulator’s approval.

Findings highlighted gaps in internal reviews, high staff turnover, lack of local resourcing, and weak senior oversight relative to the scale and risk of the business.

Timeline at a glance

| Date | Event |

|---|---|

| 2024 | Prior actions and litigation involving Binance’s Australian entity |

| Aug 22, 2025 | AUSTRAC issues a formal direction to appoint an external auditor |

| Next 4 weeks | Binance proposes auditors; AUSTRAC approves and defines scope |

Threat model snapshot

| Risk | Description | Potential impact |

| Inadequate KYC | Insufficient customer identification and verification | Fines and business restrictions |

| Weak transaction monitoring | Poorly calibrated rules and alerts | Missed SMRs, penalties and reputational damage |

| Governance | Limited local oversight and resources | Repeated compliance failures |

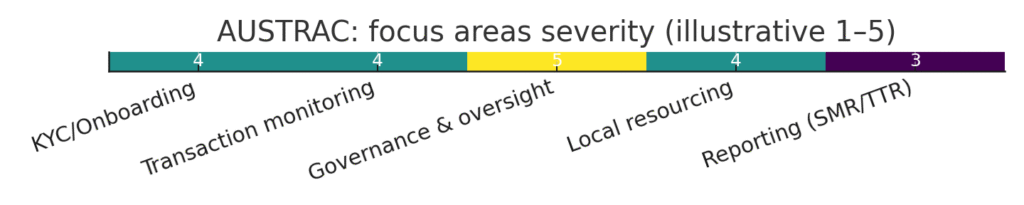

Illustrative severity heatmap for AUSTRAC focus areas

Conceptual illustration to summarize compliance focus; consult official notices for scope.

Defense playbook in practice

Local governance: empowered board and compliance officers on‑shore in Australia.

Independent audit: scope covering onboarding, monitoring, SMR/TTR reporting, and effectiveness testing.

Data lineage and quality: source inventory, reconciliations, and accuracy metrics.

Model risk management: scenario documentation, validations, and backtesting of rules.

Training: ongoing AML/CTF program with auditable records.

What it means for the market

In Australia, rising pressure to meet exchange and custody standards.

Globally, a signal of regulatory expectations: risk‑aligned AML programs with on‑shore resources and active oversight.

What to watch

Published audit scope and timetable.

Possible additional measures if findings are severe.

Impact on banking relationships and fiat on‑ramps.