Executive takeaway

DBS is moving a full structured note lifecycle to a public Ethereum rail for institutional clients. The ambition is not a single asset drop but a reusable playbook that covers issuance, distribution, settlement, and corporate actions under bank grade controls. The move sits within Singapore’s Project Guardian momentum and lines up with similar experiments by global banks that have already issued tokenized warrants and notes.

What is really new versus previous pilots

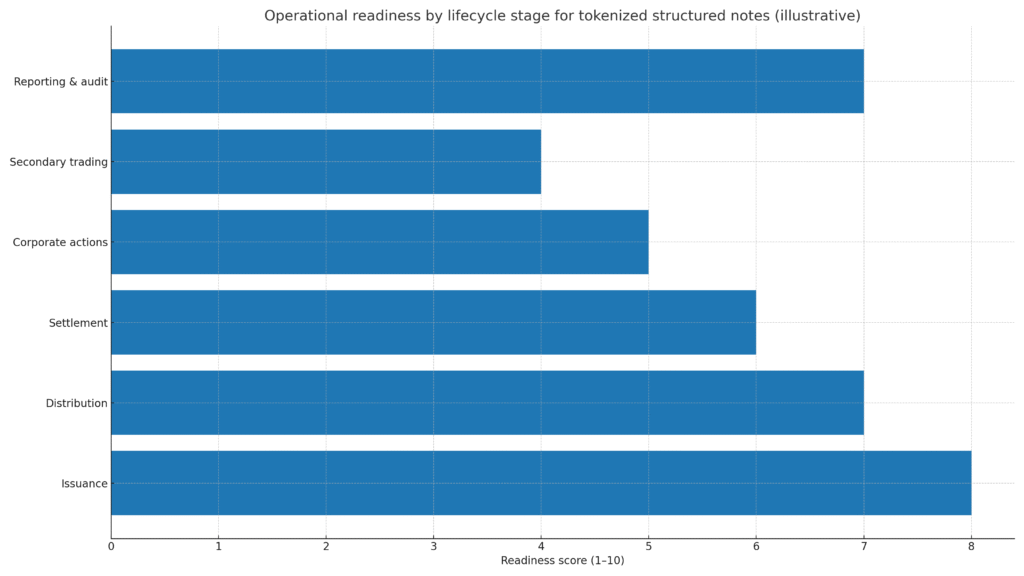

Most pilots stopped at primary issuance and a demo transfer. DBS is targeting the boring parts that create cost in production. That includes allotments recorded on a shared registry, deterministic corporate action cutoffs, and audit friendly snapshots. The bank also intends to distribute via third party venues so that custodians and brokers can consume the same on chain facts.

Lifecycle map with real world constraints

| Stage | On chain artifacts | Off chain anchors | Why it matters |

|---|---|---|---|

| Term sheet to ISIN | Instrument hash, registry entry, token ID | Product approvals and KYC files | A single reference simplifies downstream events |

| Primary distribution | Allotments, transfer rules, whitelists | Suitability records by channel | Dealers and custodians stop arguing over who owns what |

| Settlement | Delivery versus payment with time stamps | Fiat cash accounts and payment routing | Fewer fails and clearer exception handling |

| Corporate actions | Calendars and entitlement logic | Coupon payment execution and notices | One trigger, no spreadsheet wars |

| Reporting and audit | Ownership snapshots and proofs | Regulatory filings and tax packs | Audit evidence becomes a query, not a project |

Where this fits in the market

Policy alignment. Singapore’s Project Guardian created a pathway for tokenized financial assets with guardrails.

Comparables. Global banks have already tokenized warrants and issued tokenized notes on public chains. DBS is extending that muscle to the actions that happen after day one.

Distribution. The plan to list on multiple platforms is key because tokenization only adds value when more than one party reads the same state.

Controls and assurance

| Control objective | Design element | Practical test |

|---|---|---|

| Eligibility and flow of funds | Whitelists per instrument and DvP checks | Attempt an out of policy transfer and confirm the rejection path |

| Key and contract safety | HSM custody and audited contracts with a circuit breaker | Run a tabletop on kill switch and recovery procedures |

| Data minimization | No personal data on chain, permissioned reads for sensitive fields | Validate that business reporting reconstructs PII only off chain |

| Interoperability | Standard interfaces for custodians and brokers | Custodian attests positions from the on chain state, not from emails |

Interview with a transfer agent

Where do costs fall today?

Reconciliation around record dates and coupon runs. If there is one ledger of entitlements, cutoffs and payments stop drifting.

What does success look like after ninety days?

Coupons post without manual overrides, snapshots match custodian holdings, and audit pulls evidence directly from the registry.

KPIs to watch

Time to allocate in primary deals. Error rates in corporate actions. The share of positions where custodians attest from on chain data. Venue count for secondary transfers under standardized restrictions.

Related Posts

- Interview Explainer: Kenneth Rogoff revisits his 2018 Bitcoin call

- Market Forensics: Cardano and Dogecoin led losses as breadth cracked

- Adviser Briefing: UK bitcoin ETNs are opening the gate for professional and retail investors

External Sources

DBS newsroom: DBS expands blockchain capabilities by tokenising and distributing structured notes

The Block: DBS to launch tokenized structured notes on Ethereum for institutional clients

CoinDesk: DBS launches tokenized structured notes on Ethereum, expanding investor access

The Edge Singapore: DBS to tokenise structured notes on Ethereum and work with third party distribution platforms

MAS Project Guardian: Official overview of tokenization pilots and architecture

UBS media release: UBS issues a tokenized warrant on Ethereum

UBS media release: UBS and BOCI issue tokenized notes