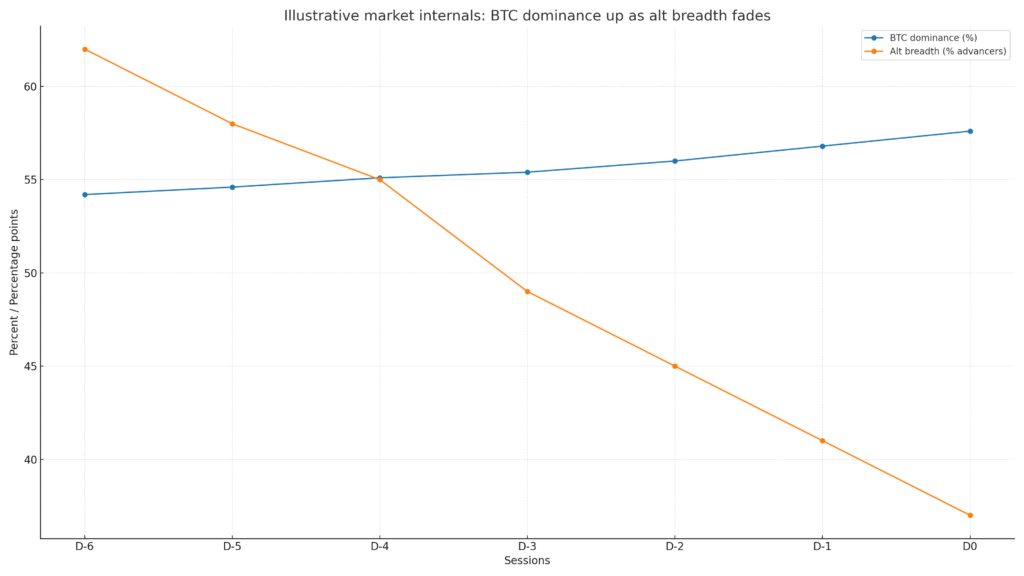

Alt breadth weakened while BTC dominance edged higher. Cardano and Dogecoin took the steepest hits as positioning cooled and liquidity concerns resurfaced. The tape looked like de-risking, not capitulation.

Daily Market Pulse

| Metric | Today’s signal | Quick read |

|---|---|---|

| BTC perpetual funding | Flat to slightly positive | Longs cooled after last week’s highs |

| ETH open interest | Down on the margin | Leverage trimmed across majors |

| BTC dominance | Drifting higher | Classic pattern when alts underperform |

| 30-day realized volatility | Elevated but stable | Risk teams stay cautious |

How we know

Market wraps show ADA and DOGE leading declines across large caps.

The macro backdrop turned less friendly with renewed liquidity worries.

Headlines around a potential 51 percent attack discussion weighed on DOGE positioning and sentiment.

Breadth and flows under the hood

| Indicator | Intraday read | Why it matters |

|---|---|---|

| Percent of large cap alts advancing | Low and falling | Confirms de-risking is broad based |

| Futures basis | Narrowing | Less room for carry trades in alts |

| Funding dispersion | Wide | Pockets of idiosyncratic stress remain |

Microstructure notes

Spreads were tighter in majors, but tail alts showed deeper air pockets.

Momentum profiles cut size and waited for a breadth turn.

Desks cited a potential liquidity drain from the US Treasury account as a near term headwind.

Scenario tree for the next 72 hours

Base case: BTC stabilizes, dominance stays elevated, alts trade sideways with a soft bias.

Bull reversal: breadth improves and funding normalizes, staggered re-entries in quality L1s.

Stress leg: a new macro or security shock revives forced selling on the tails.

What to do by persona

| Persona | Action now | Reason |

|---|---|---|

| L1 long only | Reduce size and re-scale by levels | Breadth does not confirm a bounce |

| Momentum trader | Wait for a failed breakdown or breadth turn | Avoid knife catching |

| Risk officer | Recheck LTVs and liquidation ladders | Volatility is still high |

Alt breadth versus BTC dominance across seven sessions, illustrating dominance rising while breadth falls. See file in the assets section below.

Related Posts

- Amdax Plans A Bitcoin Treasury Company For An Amsterdam Euronext Listing

Solana ‘Alpenglow’ Enters Governance: What 150ms Finality Could Mean for Validators and Apps