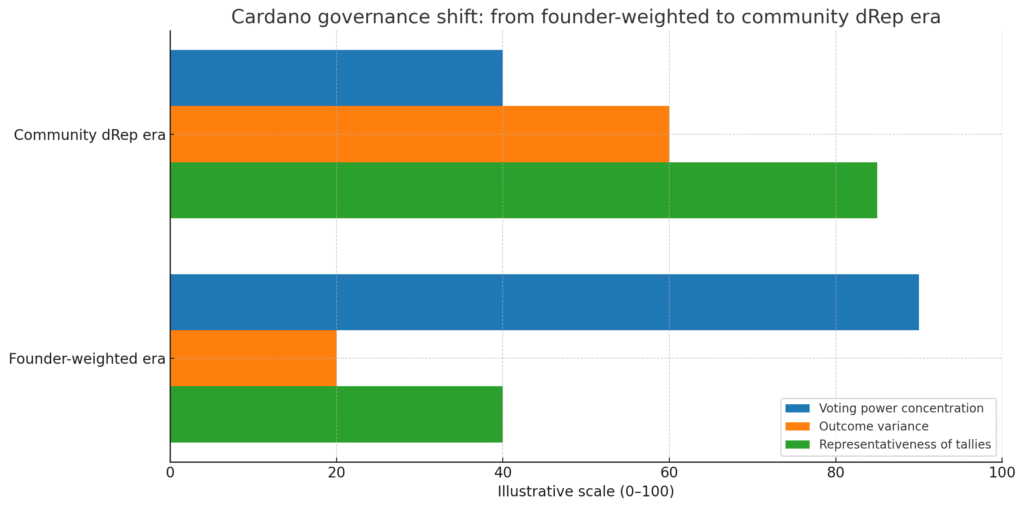

EMURGO will end its genesis ADA delegation and shift that voting weight toward community dReps. The goal is to reduce founder influence in recurring tallies and place more power in the hands of registered voters and elected representatives. This alters the distribution of voting power, not the core engineering or review process.

Town hall transcript, condensed

Moderator. What does ending genesis delegation actually do

Governance lead. It removes a centrally assigned vote block and pushes weight toward registered dReps and self directed wallets. The idea is to minimize founder bias and let active participants set outcomes.

Moderator. Does this reduce stability in votes

Governance lead. Close proposals may show more variance. That is intentional. With better summaries and wallet prompts, variance should reflect real preferences rather than a fixed anchor.

Moderator. What should a dRep do next

Governance lead. Publish a platform, disclose conflicts, and set a cadence for voting rationales. If you represent many delegators, you owe them a visible paper trail.

Moderator. What should a stake pool operator expect

Governance lead. More conversations with delegators about how pool identity intersects with governance. Add a governance page and a schedule for proposal reviews.

Moderator. What should ordinary ADA holders look for

Governance lead. A clean path to register, a roster of dReps with track records, and an easy way to switch support if a representative stops publishing rationales.

Policy snapshot

Voting weight shifts from a founding allocation to community dReps and registered wallets.

Disclosure standards for dReps rise, including platforms, conflicts, and per vote notes.

Turnout matters more than ever. Wallet UX and explorer views will move participation.

Guardrails remain. Treasury controls, thresholds, and security reviews protect against speed without scrutiny.

Technical continuity holds. Roadmap and code review proceed as before. The change is about who holds the gavel.

Decision flow for stakeholders

Are you a registered dRep

Yes. Publish priorities and explain how you weigh throughput, security, and decentralization. Commit to a reporting cadence.

No. Decide whether to register or delegate to a representative whose rationale you trust.

Are you a stake pool operator

Yes. Add a governance page. Explain how you view parameter changes and treasury grants that affect performance or fees.

No. If you delegate through a pool, ask whether the operator will take public positions on major proposals.

Are you a long term holder who rarely votes

If you prefer not to evaluate each proposal, delegate to a diligent dRep and set a rminder to review their record. Switching should be easy and low risk.

What this unlocks for builders

Clearer mandates. Passed proposals carry less founder drift and more community legitimacy.

Better governance UX. Wallets and explorers can compete on summaries, simulations, and dRep dashboards.

Useful telemetry. With weight more distributed, participation analytics become inputs for future upgrades.

Risks and mitigations

Low turnout. If few register, weight concentrates in a handful of dReps. Mitigate with prompts, digests, and frictionless delegation switches.

Information overload. Too many proposals can bury critical items. Use tags, deadlines, and digest views.

Coordination games. Whisper networks among large holders may appear. Counter with disclosure rules and timestamped rationales.

Short term bias. Popular but costly grants can pass in a hot market. Use staged funding, milestones, and clawbacks where appropriate.

Governance etiquette for dReps

Publish voting frameworks before major cycles.

Explain trade offs in plain language.

Declare conflicts of interest when relevant.

Keep a public archive of votes and rationales.

Offer regular office hours for questions.

FAQ

Does this change monetary policy or emissions

No. Any change still requires an explicit proposal and formal review.

Is EMURGO stepping away from the ecosystem

No. The shift addresses voting weight, not participation in development or partnerships.

Do delegators lose anything today

No. Staking remains the same. You gain clearer control over where your governance weight goes.

How do I evaluate a dRep

Look for platform clarity, past accuracy on technical points, transparent conflicts, and a consistent publication cadence.

What to watch next

New dRep registrations and the share of ADA they attract

Turnout changes once wallet prompts and governance views ship

Variance on close proposals under the new distribution

Treasury grant discipline with a more distributed electorate

Retro audits that score dReps on disclosure and follow through